Seizing the Future Trends of Fintech, VSTE Leads the New Direction of A.I. Investment

2023-09-20

According to the latest report from the Fintech Lab of Tsinghua University’s School of Finance: In the first half of 2023, there were a total of 977 investment and financing events in the global fintech industry, with a total amount of 62.8 billion US dollars. The number and amount of investment and financing in the second quarter increased compared to the first quarter. It is evident that under the strong endorsement of artificial intelligence, the trend of fintech is emerging and is experiencing unprecedented vigorous development.

At the same time, the continuous introduction of hedging tools in the financial industry has brought about earth-shaking changes in the product structure and operation methods of asset management. Intelligent analysis and quantitative hedging trading have become inevitable choices for the development of the financial field. In recent years, A.I. arbitrage investment has swept traditional financial fields such as stocks and futures in a wave-like manner. VSTE, as a leader in the A.I. arbitrage industry, is constantly following the wave of fintech and leading the new direction of intelligent investment.

◎Fintech Enters a Period of Rapid and Exceptional Development

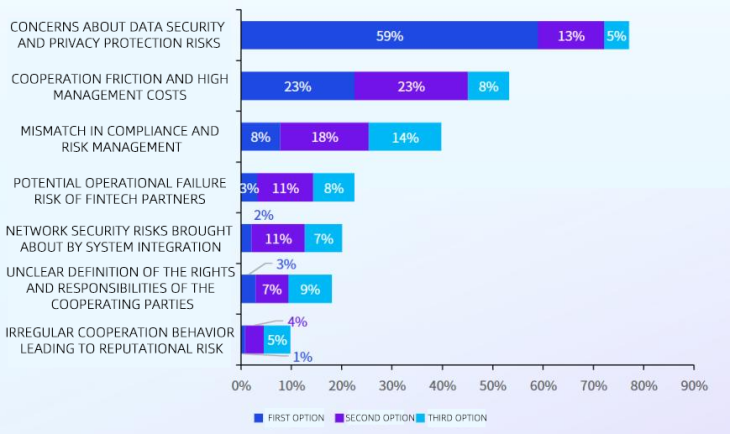

In 2023, nearly 77% of global enterprises will regard ‘concerns about data security and privacy protection risks’ as the main difficulty in cooperating with financial institutions and fintech companies, a decrease of 5 percentage points from last year.

Data Source: 2023 Fintech Enterprise Chief Insight Report

Given the high-risk nature of data, and being the gate-keeper for hundreds of millions of financial users worldwide, information security has always been a critical issue for companies operating in the financial industry.

Information security is a significant concern in the fintech industry due to the high-risk nature of data. Almost every iteration and upgrade focuses on this field’s technology. Investment companies, represented by VSTE, are an important branch of fintech. The safety of operations and privacy protection during the user’s investment process are the foundation of corporate development. The ability to break through the technical barriers of data security and reduce such cost inputs undoubtedly paves the way for the subsequent development of the industry.

VSTE’s sports arbitrage platform ensures the safety of investors’ interests. With years of investment industry experience, the technical research and development team has established a robust risk control strategy system. When users carry out sports arbitrage operations, they use AI to intelligently scan sports data across the web, detect hundreds of transactions simultaneously, monitor odds changes for each match independently, and monitor betting conditions in real-time. They filter and sort by multiple categories to help users intelligently determine the optimal combination, achieving truly risk-free arbitrage and allowing ordinary investors to obtain safe and stable returns.

◎Fintech Industry Places Greater Emphasis on Enhancing Technological Competitiveness

Compared to 2022, the demand for technological improvement in fintech companies accounts for 53%, surpassing the needs for brand establishment and talent acquisition. Technological upgrades have once again become the main direction of development for the industry in the coming years.

The history of technology integration into finance is a brief one, but due to the rapid development of data technology, traditional financial institutions face significant risks in transitioning to new methods. Most will acquire the products and services of fintech companies to fill the technological gaps in their businesses, ensuring the business layout and development interests of both parties.

Moreover, technological support is often the lifeblood of a company. Therefore, the current fintech industry has gradually developed in the direction of ‘strength is king’.

In the financial investment market, technological upgrades such as A.I. and big data algorithms are also of significant importance to individual investors. They assist investors in making more efficient and accurate investment strategies, and enable them to quickly grasp market changes, opening a door to a more precise and efficient trading world for individual investors.

VSTE has been deeply involved in the sports arbitrage industry for 11 years, using cutting-edge technology as the foundation for development, and is committed to helping users achieve high returns and low risks in sports arbitrage. For this purpose, VSTE has developed its own intelligent arbitrage system, which combines AI technology to intelligently capture odds across the web and perform millisecond-level data comparison. It provides users with intelligent services such as one-click entrust and arbitrage calculators. At the same time, it has a professional sports data API interface, covering 15+ global sports data, truly using technology to connect B-end and C-end markets.

In the face of the emergence of various new concepts such as big data and artificial intelligence, the combination of finance and technology has become an inevitable trend. VSTE has targeted the blue ocean market of sports arbitrage in the investment field, and continues to upgrade and iterate on intelligent investment technology and services. In the future, it will continue to follow the development of fintech, providing investors with more efficient and higher quality investment channels.